Prolific natural gas and oil development continues to drive investments in the Buckeye State. The total investment in shale-related activities in Ohio reached $86.4 billion as of Q4 2019, an increase of $9 billion since 2018, according to Cleveland State University’s latest shale investment report.

This is the eighth annual report CSU has conducted for JobsOhio, in which it collected and analyzed investment data related to the Utica and Point Pleasant shale formations through the second half of 2019. From the report:

“Total investment from July through December 2019 was approximately $3.06 billion, including upstream, midstream and downstream. Indirect downstream investment, such as development of new manufacturing as a result of lower energy costs, was not investigated as part of this Study. Together with previous investment to date, cumulative oil and gas investment in Ohio through December of 2019 is estimated to be around $86.4 billion. Of this, $60.0 billion was in upstream, $20.2 billion in midstream, and $6.2 billion in downstream industries.”

Despite a slight decrease in investment in the second half of 2019 compared to the same period in 2018,, production data by Ohio Department of Natural Resources Division of Oil and Gas (ODNR) show that the total volume of gas-equivalent shale production was actually 11.3 percent higher than in the first half of the year. In fact, thanks to the abundance of the resource – Ohio is the fifth largest natural gas producer in the United States – natural gas became Ohio’s primary fuel source of electricity generation in 2019.

Upstream: Fewer Wells, Higher Production

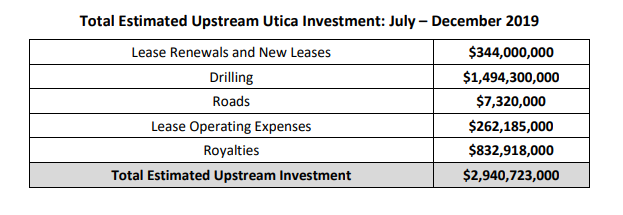

The CSU research team found that total upstream investment was slightly down by 10 percent in the second half of 2019 compared to the first half, primarily due to fewer wells being drilled, but quarterly production was at the highest it has ever been since the beginning of development in Utica. Upstream activities, including costs of drilling new and operating existing wells, royalties and lease bonuses, accounted for $2.9 billion of the total $3.06 billion combined from all segments.

ODNR listed 122 new wells as “drilled,” “drilling” or “producing,” bringing the total number of producing wells in the Utica to 2,709 as of December 31, 2019. The report further breaks this down by county-level:

“Belmont County was the leader in new upstream investment, with 31 new wells and in investment of around $401.8 million between July and December of 2019. Jefferson and Harrison Counties were second and third, with 29 and 18 new wells, respectively, to go along with $332.3 and $206.3 million invested.”

CSU found in previous reports that Ohio’s upstream activities were moving from the north to the south of the Utica, but the trend now seems to suggest that upstream activities are becoming less concentrated in southern counties of the Utica:

“Drilling data for these counties indicate that there is now almost one new shale well drilled in the north for every one drilled in the south, down from a ratio of more than two southern wells for every northern well in 2018.”

Promising Outlook in Midstream and Downstream

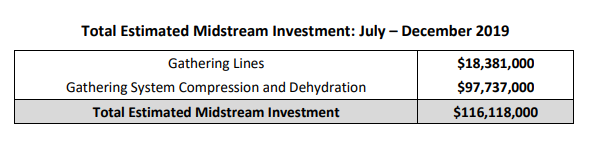

The estimated total midstream investment yields roughly $116.1 million, which includes transmission and gathering pipelines, additional investments in storage facilities and compressor stations. The slow growth in the midstream segment during this period can be explained by the absence of no major intrastate or interstate pipeline projects that broke ground and completion dates pushed further in 2020.

The spending that did occur in the latter half of 2019 was focused on gathering system pipelines ($18.4 million) and gathering system compression and dehydration ($97.7 million).

The new compressed natural gas (CNG) fueling station at the UPS fleet garage in Middleburg Heights and a $2.5 million hydrogen generation unit at an oleochemical manufacturing facility in Cincinnati accounted for all downstream-related investments in the second half of 2019.

Midstream and downstream investments were similarly down in the second half of 2019, but researchers predict that there will be a significant increase in the next installment of the report given interstate pipeline expansion projects and additions to natural gas liquids (NGLs) processing capacity that took place in 2020, as well as major construction on the $1.6 billion Guernsey Power Station that began early site work toward the end of 2019 but did not commence until early 2020.

“The $4.2 billion in midstream and downstream mergers and acquisitions during the Study period suggest likely future growth for these segments, although it is still unclear how much COVID-19 will affect the timeline for this growth.”

Conclusion

The investments in Ohio’s energy in the last eight years have not only brought tremendous savings benefits to consumers, but also created jobs and contributed to the nation’s environmental progress. As the Department of Energy recently emphasized, the need for continued investments in public infrastructure, workforce development and innovation to ensure that natural gas produced here will continue to provide manufacturers and industries with a reliable supply:

“[A] major component of the United States economic recovery will be the abundance of reliable, affordable energy to enable United States manufacturing and other sectors of the economy to reignite the pre-pandemic boom.”

This post appeared first on Energy In Depth.