SK Holdings is one of the largest conglomerates in South Korea, and the 57th largest company in the world. Bet you didn’t know that! SK is composed of 95 subsidiary companies with 70,000 employees and has its fingers in many pies, including telecommunications, manufacturing and chemicals. One of SK’s core businesses is energy. Yesterday the company made a major investment in energy by investing in Blue Racer Midstream, a gathering and processing system with 700 miles of pipelines in Ohio and West Virginia, the heart of the Marcellus/Utica.

When we say “major investment,” we mean SK invested either $300 million, or $150 million. We’re not sure which!

Late last year investment firm First Reserve bought out Dominion Energy’s 50% share in Blue Racer for $1.5 billion (see Dominion Sells Its 50% Share in Blue Racer Midstream for $1.5B). On Tuesday, First Reserve issued the following press release that says SK is investing $300 million in Blue Racer:

First Reserve, a leading global private equity investment firm exclusively focused on energy, today announced an agreement with SK Holdings Co., Ltd. (“SK”), a top two conglomerate in South Korea, for an investment of $300 million into a fully integrated midstream company in the Utica and Marcellus Shale plays.

Blue Racer Midstream, LLC (“Blue Racer” or “the Company”) is a portfolio holding of First Reserve Fund XIII, funded in part by equity from First Reserve Fund XIII and investment funds affiliated with First Reserve, following the acquisition of a 50% interest in December 2018. The Blue Racer investment represents a sizeable addition to SK’s North American midstream platform as well as the formation of a strategic relationship with energy investor First Reserve.

SK’s diverse global portfolio of investments focus on driving competitive, long-term shareholder value in key growth industries such as the energy sector. As a strategic investor, SK will work alongside First Reserve and company management in supporting Blue Racer’s growth and initiatives to expand the Company’s regional footprint.

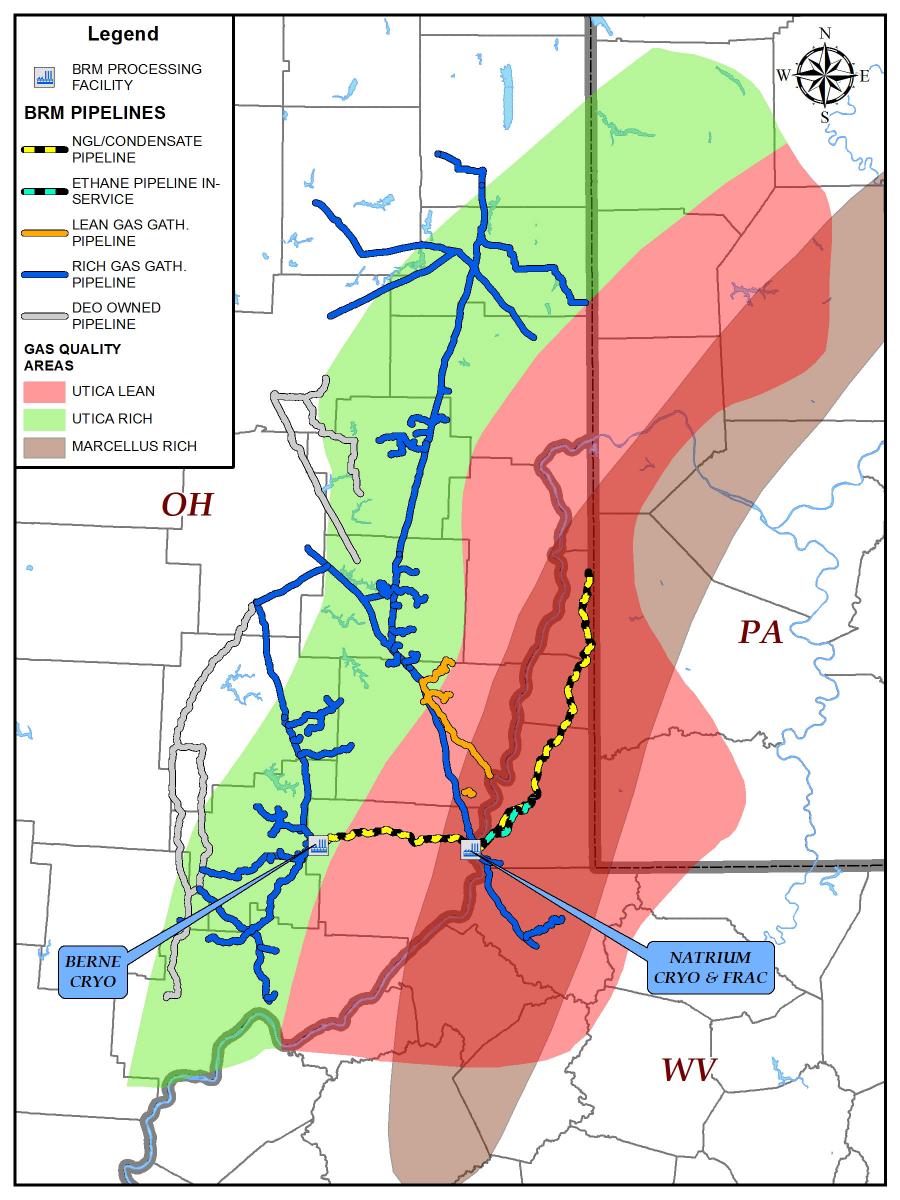

Blue Racer owns, operates, and develops midstream assets in the Utica and Marcellus Shale plays of the United States. The Company provides interconnected midstream functionalities with more than 700 miles of gathering pipeline and 1 billion cubic feet per day of cryogenic processing capacity. Blue Racer believes its strategically located assets and contractual relationships with material customers will allow it to retain and grow its position as a leading midstream company serving customers in the Appalachian basin.

Alex Krueger, President & CEO of First Reserve, stated, “With over 35 years’ experience as energy-focused investors, First Reserve has developed what is in our view a deep understanding of the global energy value chain, energy operations, and the key centers of energy activity. We believe Blue Racer is a well-positioned business in a growing market, and we are excited to welcome SK as a strategic investor in the company. We believe this partnership will serve as a strong complement to our expertise, and we deeply value the experience that SK will bring to the Blue Racer investment. We look forward to a long-term relationship with the SK organization as we seek to drive growth on behalf of both Blue Racer and our stakeholders.”

Dong Hyun Jang, CEO of SK Holdings Co., Ltd. added, “SK has built a substantial platform of energy investments throughout North America, providing what we believe is a robust investment foothold in an energy epicenter. This investment in Blue Racer and the partnership with First Reserve, a leading global private energy investment firm, are a continuation of that investment thesis – and the opportunity to combine our strategic expertise with experienced energy players. We believe Blue Racer is a premier midstream operator, and we look forward to helping build value through our energy business capabilities and synergy with shale-related assets in the U.S.”

Transaction terms were not disclosed.

About First Reserve

First Reserve is a leading global private equity investment firm exclusively focused on energy. With over 35 years of industry insight, investment expertise and operational excellence, the Firm has cultivated an enduring network of global relationships and raised approximately USD $31 billion of aggregate capital since inception. First Reserve has completed over 650 transactions (including platform investments and add-on acquisitions), creating several notable energy companies throughout the Firm’s history. Its portfolio companies have operated on six continents, spanning the energy spectrum from upstream oil and gas to midstream and downstream, including resources, equipment and services, and associated infrastructure. Please visit www.firstreserve.com for further information. (1)

Fair enough, no reason not to believe First Reserve that SK will pony up $300 million. Except we noticed a number of articles published in Korea that say SK actually invested $150 million, and two other companies matched it and invested another $150 million. Here’s an example:

South Korea’s SK Holdings said on Thursday that it has decided to invest $150 million in Blue Racer Midstream, a U.S. natural gas gathering and processing (G&P) company.

SK Holdings will carry out the investment project as a strategic investor for First Reserve, a private fund specializing in energy. Mirae Asset Daewoo Securities and Samsung Securities will join in to push the project with an additional $150 million through a fund established by Stick Alternative.

G&P business involves gas gathering from a gas field through pipelines and processing it for sales to consumers.

Blue Racer Midstream founded in 2012 is a leading G&P company in the Marcellus-Utica Basin, the largest natural gas production area in the U.S. The basin spans the border between Ohio and West Virginia. Blue Racer has a 1,100-km-long pipeline and a facility capable of processing 7.3 million tons of natural gas per year. Its equipment able to separate gas components with a capacity of 4.2 million tons per year helps extend business value to customers who want the separation between ethane and propane from gas by-products.

More than 90 percent of Blue Racer contracts have a fixed rate over 10 years for local customers, enabling stable supplies with a low risk from oil price fluctuations.

Natural gas output in the Marcellus-Utica Basin is estimated to reach 880 million tons between 2018 and 2025, about half of the total across North America, according to energy consultancy Wood Mackenzie Power & Renewables. (2)

As near as we can tell, Mirae Asset Daewoo Securities and Samsung Securities are not subsidiary companies of SK Holdings. If they are, that explains First Reserve’s press release saying SK is investing $300 million. If they are not, First Reserve’s press release is in error. Or perhaps SK and these other two companies are in some sort of joint venture? We just don’t know.

The bottom line, big news is that South Korea has an interest in Marcellus/Utica midstream infrastructure, buying a piece of it from First Reserve. Perhaps some of that money will actually go for expansion work? That would be nice!

(1) First Reserve (Mar 27, 2019) – First Reserve Announces Strategic Investment By South Korean Company SK Holdings Co., Ltd. In Blue Racer Midstream, LLC

(2) Pulse (Mar 29, 2019) – SK to invest $150 mn in U.S. shale gas firm Blue Racer

This post appeared first on Marcellus Drilling News.