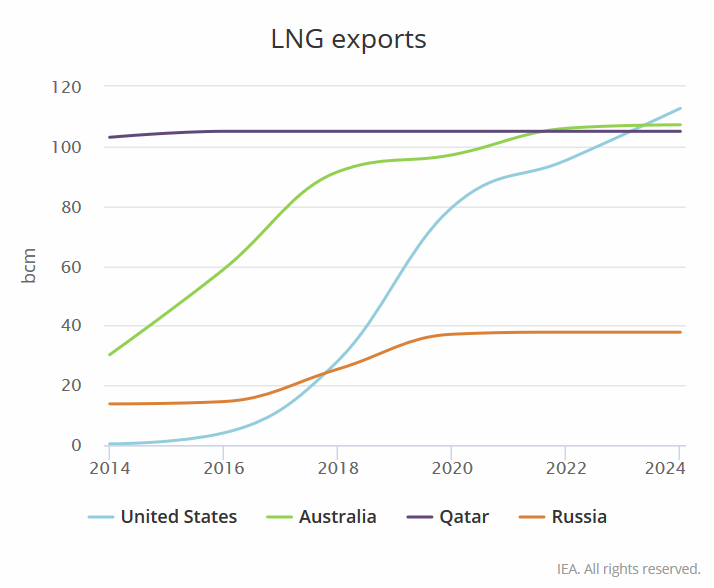

The United States – currently the third largest exporter of liquefied natural gas – will surpass Australia and Qatar to become the world’s largest exporter of LNG within five years, according to a recent International Energy Agency report.

The United States Will Continue to Rapidly Grow Its LNG Exports.

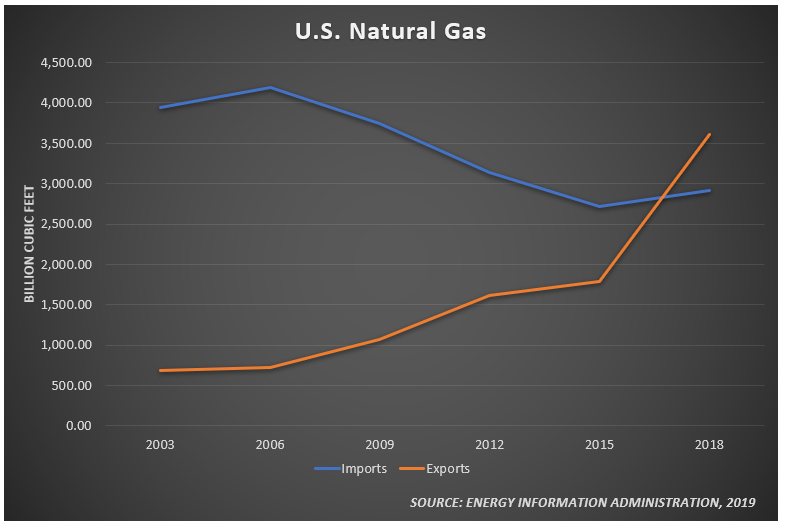

The United States exported nearly 1.6 trillion cubic feet (tcf) of natural gas in 2013. By 2018, that number had more than doubled to 3.6 tcf, with LNG representing nearly one-third of total U.S. natural gas exports, thanks to record-breaking U.S. shale production.

IEA predicts that by 2024 U.S. LNG exports will grow by more than 3.5 percent to reach a whopping 113 billion cubic meters, or nearly 4 tcf, overtaking Qatar and Australia as the largest LNG supplier.

The United States’ Natural Gas Transformation

The United States’ transformation into an LNG superpower is even more incredible considering that it wasn’t so long ago that the country was in the middle of a natural gas shortage. In 2003, Time ran an article with the headline “Why U.S. Is Running Out of Gas,” that explained:

“This comes at a time when Americans are heading into their first big energy squeeze since the 1970s: a shortage of natural gas, the invisible resource used to heat homes, fuel kitchen appliances, generate electricity and manufacture many of the chemicals we use.”

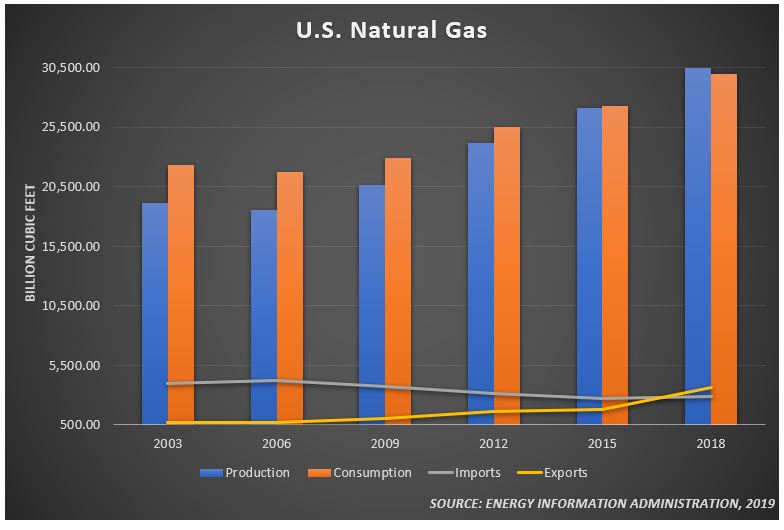

In 2003, U.S. natural gas production represented about 85 percent and natural gas imports nearly 18 percent of the total natural gas consumed in the country, according to the Energy Information Administration. But the ability to produce natural gas from shale has transformed the United States from a position of energy scarcity to one that enables it to not only meet its own demand, but supply the world with this important resource as well.

The United States experienced a 59 percent growth in natural gas production since 2003 – U.S. production in 2018 outpaced consumption by about two percent and natural gas imports fell roughly 26 percent over this time period.

This trend is expected to continue with IEA predicting that by 2024 the United States will represent more than one-third (35 percent) of global natural gas production growth.

The Incredible Growth of U.S. LNG

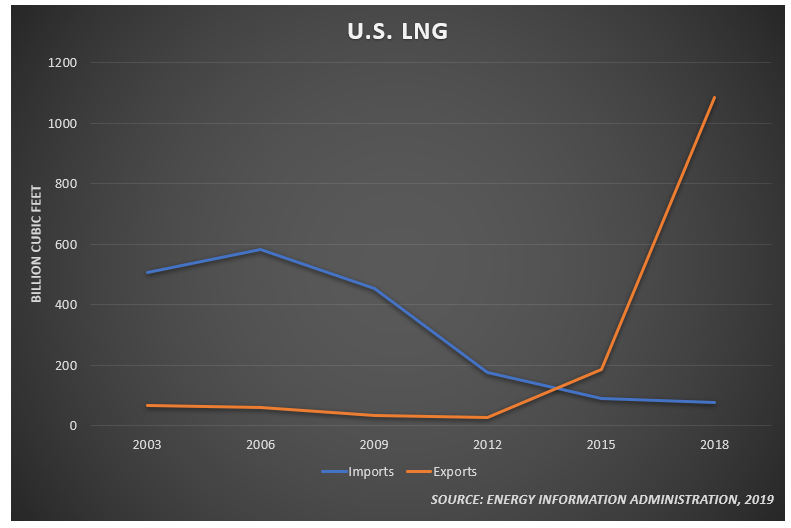

The first shipment of U.S. LNG from the lower 48 states was exported in February 2016, and it has been full-speed ahead ever since. As Reuters reported shortly before the shipment left Louisiana:

“Expected to become an importer of LNG just a decade ago, the shale gas revolution in the United States that unlocked cheap, abundant supplies has wreaked havoc on global gas markets as LNG meant for the country was redirected around the world.”

U.S. LNG exports more than quintupled from 2016 to 2018, with the United States exporting a record nearly 1.1 tcf of LNG in 2018. That’s about 189 billion cubic feet (bcf) more than 2016 and 2017 combined.

And as the IEA report explains, there are no signs of this growth slowing down. At the end of May, the Department of Energy announced the Freeport LNG terminal in Texas was approved to export additional domestically produced natural gas. As U.S. Under Secretary of Energy Mark W. Menezes explained:

“Increasing export capacity from the Freeport LNG project is critical to spreading freedom gas throughout the world by giving America’s allies a diverse and affordable source of clean energy. Further, more exports of U.S. LNG to the world means more U.S. jobs and more domestic economic growth and cleaner air here at home and around the globe. There’s no doubt today’s announcement furthers this Administration’s commitment to promoting energy security and diversity worldwide.”

Federal Energy Regulatory Commission (FERC) Chairman Neil Chatterjee also lauded the recent DOE announcement via tweet, pointing out increasing European imports of U.S. LNG.

Facts are facts. @ENERGY is right – it is #FreedomGas! #LNG is good for the American people, our allies abroad & for U.S. geopolitical interests. #FreedomMolecules #Energytwitter #FERC

— Neil Chatterjee (@FERChatterjee) May 30, 2019

EIA reported that in March and April of this year, U.S. LNG exports to Europe averaged 1.7 billion cubic feet per day (bcf/d), ten times higher than in the same months in 2018. While touring an LNG export facility in the U.S., European Union Commission Vice President Maroš Šefčovič told Axios:

“We are at the stage when these facilities become commercially very important. We have demand. We have infrastructure in place. The U.S. now has the export capacity.”

As the IEA report explains:

“While European gas consumption is set to remain almost flat in the coming years, domestic production is set to fall at an average rate of 3.5% per year, primarily driven by the Groningen phase-out in the Netherlands and declining production in the North Sea.

“This structural decline in domestic production, combined with the expiry of several long term pipeline contracts, opens opportunities for new sources of supply, including LNG.” (emphasis added)

Worldwide Natural Gas Demand Projected to Grow

The increased supply of LNG is being fueled by not only an increased U.S. supply, but growing global natural gas demand. According to IEA, worldwide demand grew by 4.6 percent in 2018 and will continue to increase through 2024:

“Gas demand in the coming five years is set to be driven by Asia Pacific, forecast to account for almost 60 percent of the total consumption increase to 2024. China will be the main driver for gas demand growth, though slower than in the recent past as economic growth slows, but still accounting for about 40 percent of total gas demand increase to 2024.”

Conclusion

The growth of U.S. natural gas production – led by increased shale production – has been transformative, not only domestically but globally. And it’s only the beginning. As IEA Executive Director Fatih Birol recently said:

“The second wave of the U.S. shale revolution is coming. It will see the United States account for 70 percent of the rise in global oil production and some 75 percent of the expansion in LNG trade over the next five years. This will shake up international oil and gas trade flows, with profound implications for the geopolitics of energy.”

This post appeared first on Energy In Depth.