The following information is provided by BOK Financial Securities Inc. All inquiries on the following listings should be directed to BOK Financial Securities. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Unit Petroleum Co. is offering for sale producing operated properties and associated water and gathering lines in central Kansas. The company retained BOK Financial Securities as its exclusive adviser in connection with the sale.

Highlights:

- Asset Overview

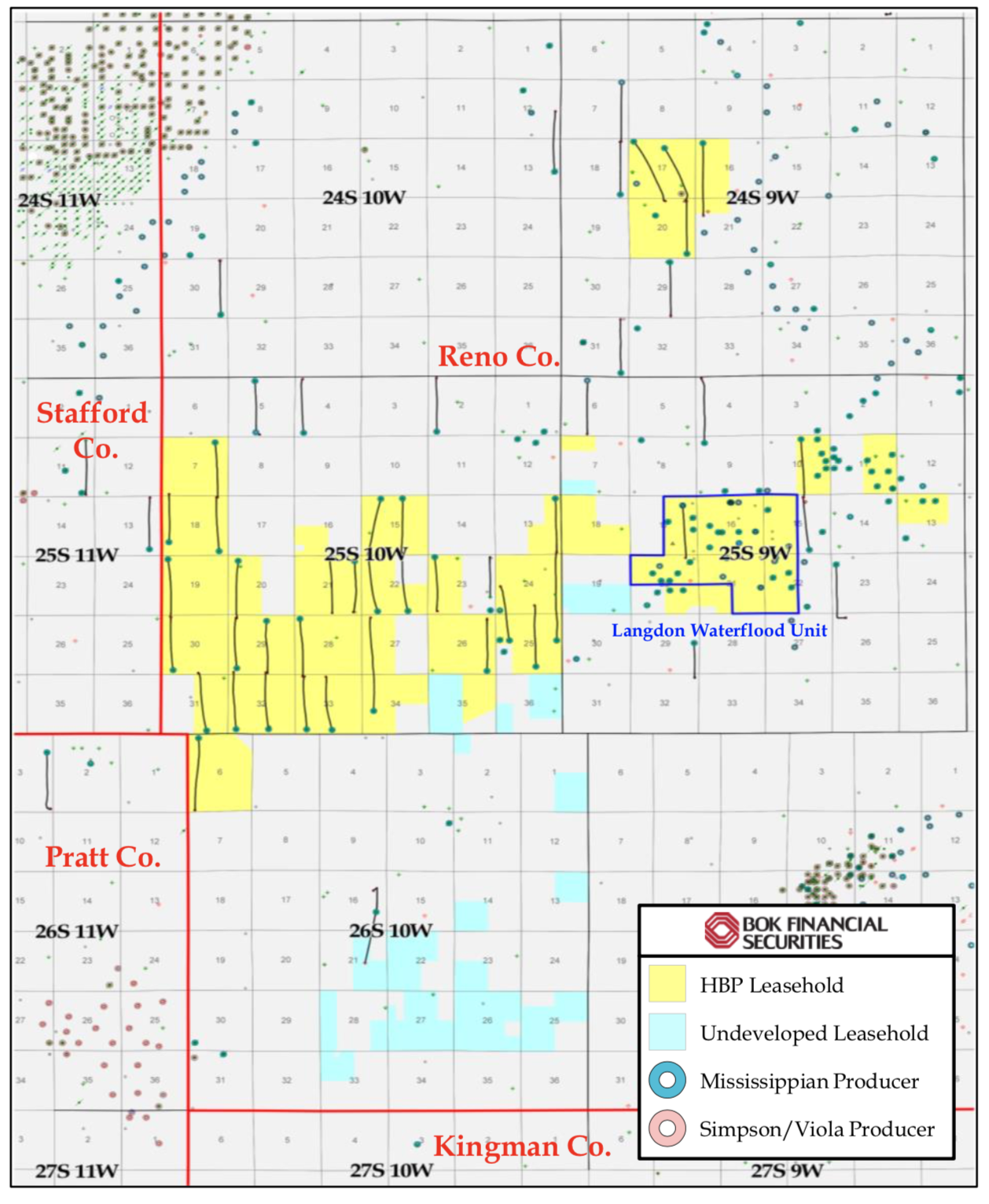

- 21,940 net acres (82% HBP) concentrated in the Sedgwick Basin in western Reno County, Kan.

- 100% Working Interest / 81.5% Net Revenue Interest

- 33 operated producing wells and one nonoperated producing well

- Primary producing targets is Mississippi Chert

- Excess capacity in 100% owned saltwater disposal system and natural gas gathering lines

- 21,940 net acres (82% HBP) concentrated in the Sedgwick Basin in western Reno County, Kan.

- Production & Cash Flow Profile

- Steady production base established by 2013-14 vintage horizontal wells

- December 2020 net production of 222 bbl/d of oil, 904 Mcf/d of gas and 88 bbl/d of NGL

- PDP R/P of 7.1 times

- 6% oil decline (current)

- Trailing three-month average net cash flow of $116,000 per month

- Steady production base established by 2013-14 vintage horizontal wells

- Upside Opportunities

- Langdon Waterflood Unit, unitized in 2017, is currently in fill-up stage (injecting 4,115 bbl/d of water)

- Operational upside from centralized compression and pump changes

- Six 3D supported Mississippian PUD locations

- 86 squares of Proprietary 3D available to license

- Additional exploratory potential in the Lansing-Kansas City, Viola and Simpson formations

Bid are due Feb. 11. The transaction is expected to have a Feb. 1 effective date. A virtual data room is open.

For information, contact Jason Reimbold at [email protected] or Jeff Hawes at [email protected].

This post appeared first on Hart Energy.