The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

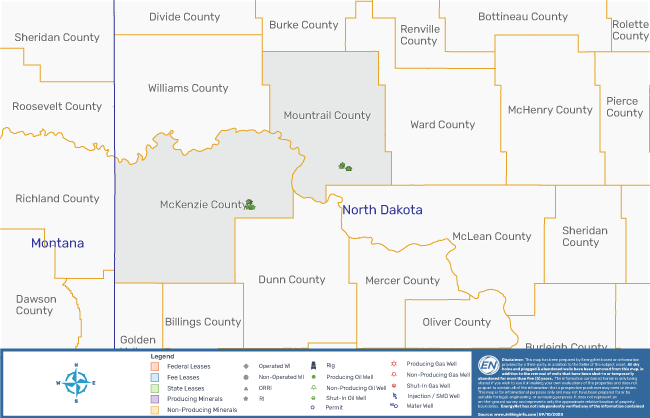

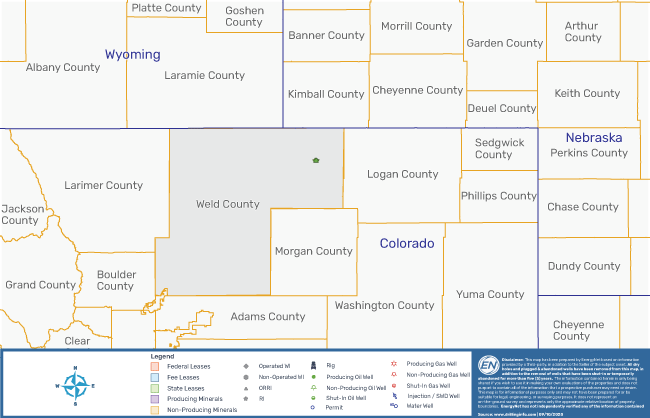

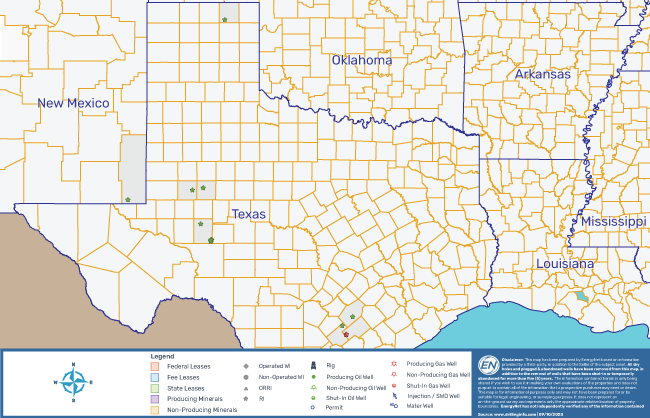

Strategic Pipeline Income Fund retained EnergyNet for the sale of a 143 well package that includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest in Colorado, New Mexico, North Dakota and Texas.

Highlights:

- Nonoperated Working Interests, ORRI and Royalty Interests in 99 Properties (143 Wells – Six Wells WBO)

- 0.2568% to 0.021204% Working Interest / 0.592703% to 0.015691% Net Revenue Interest

- 0.099834% to 0.033126% ORRI

- 0.634796% to 0.042069% Royalty Interest

- 80 Producing Properties | 15 Non-Producing Properties | Four Confidential

- Six-Month Average 8/8ths Production: 10,402 bbl/d of Oil and 46,154 Mcf/d of Gas

- 11-Month Average Net Income: $18,872 per Month

- Select Operators include ConocoPhillips Co., Devon Energy Corp., EOG Resources Inc., Sable Permian Resources LLC and Whiting Petroleum Corp.

- Weld County properties in Colorado are further subject to Documentary Stamp fees

Bids are due by 1:40 p.m. CST Feb. 10. For complete due diligence information on either package visit energynet.com or email Zachary Muroff, vice president of business development, at Zachary.Muroff@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

This post appeared first on Hart Energy.