American consumers are reaping the benefits of soaring natural gas production, pocketing over $1.1 trillion in savings over the past 10 years, according to a new report released by Shale Crescent USA and the Ohio Oil & Gas Energy Education Program.

The analysis shows growth in domestic natural gas production resulted in more than $4,000 in savings per household over the 10-year period for those who use natural gas, and billions of dollars saved by manufacturing end users in the Shale Crescent region of Ohio, Pennsylvania and West Virginia. The price of natural gas has dropped as a result of dramatically increasing production from shale, with the majority of new growth coming from the Appalachian Basin.

$1.1 Trillion Saved

The cost-savings have grown in tandem with increased shale development, and include substantial benefits across residential, commercial, industrial, and electric power sectors, the report found.

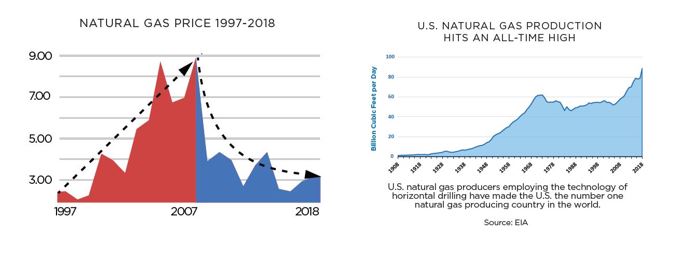

Natural gas costs – which have fallen 65 percent from $8.86 per thousand cubic feet in 2008 to $3.08 last year – have a direct impact on almost all goods and services. When distributing the cumulative $1.1 trillion in savings to each of America’s 125 million households, the average annual savings equate to $900 per household per year, or $9,000 in savings since 2008.

The savings were even higher – $4,000 annually – in households that directly use natural gas. And for households in the lowest 20 percent of income, the realized savings equate to 2.7 percent of annual income, the data show. As Rhonda Reda, executive director of the Ohio Oil and Gas Energy Education Program told Oil and Gas Journal, getting a 2.7-percent boost in income is meaningful for these families:

“The savings tied to [Shale Crescent] natural gas production have been transformational for all energy consumers, particularly for low-income families who spend a disproportionate amount on energy.”

Appalachia Leads Growth

Texas and other natural gas producing states along the Gulf Coast have historically provided most of the growth in natural gas supply. But since 2008 – as horizontal drilling and hydraulic fracturing were utilized to develop tight formations and shale across the country –the Shale Crescent region has produced the greatest amount of production growth. Ohio, Pennsylvania and West Virginia have increased their combined production 20-fold in the past decade, representing 85 percent of total U.S. natural gas growth in that time span.

Last year, they produced 28 billion cubic feet per day of marketed natural gas, accounting for nearly one third of all U.S. production. This trend is expected to continue into the future, as a recent IHS Markit study projects the region will supply 45 percent of U.S. natural gas production by 2040.

The volume of these natural gas resources is attracting the kinds of manufacturing and petrochemical industry investments leaders in all three states hope continues, while those who work in these sectors are already experiencing the benefits of operating in the region.

Appalachia Sees Growth

Consumers in the Shale Crescent states have realized benefits at a high rate, given their proximity to production, with a combined savings of more than $90 billion over the past 10 years, the report shows. For just industrial and manufacturing end users in the tri-state, the savings eclipse $25 billion.

Potential for future growth in these industries has been covered in previous studies of the region by IHS, which forecasted energy intensive industries locating in the area should experience significantly higher profits than other regions of the country thanks to lower natural gas and natural gas liquids prices. This is particularly true for petrochemical companies.

Joe Eddy, the former president and CEO of Eagle Manufacturing, which produces more than 750 products from its Wellsburg, W.Va. site, has recognized the benefits of low-cost natural gas in comments to West Virginia News:

“The surge of affordable, reliable energy had an incredibly positive impact on our operations. The natural gas savings we realized were the driving force in reducing operating costs, which allowed Eagle to invest in new equipment, expand our workforce and grow as a company.”

Conclusion

The International Energy Agency projects petrochemicals will drive demand for oil and natural gas through 2040. Keeping the United States competitive and able to meet these growing demands is why the Department of Energy and groups like Shale Crescent USA continue to promote the viability of the region as a second petrochemical hub alongside the Gulf.

The Ohio River Valley’s rise as a petrochemical hub is already beginning to take shape, with Shell’s $6-billion cracker plant under construction in Beaver County, Pa.; the highly anticipated PTT Global Chemical project potentially set to be announced in Belmont County, Ohio; and a number of similar projects in various stages of discussion.

This latest study adds to a growing number of those demonstrating the viability of the region, a key fact Jerry James, president of Artex Oil and Shale Crescent USA co-founder, shared with the News and Sentinel:

“The strength of natural gas and natural gas liquids production in the Shale Crescent region, as this report confirms, has made this region the most profitable place to build a petrochemical plant, giving manufacturers here a critical competitive edge. Energy is the catalyst to breathing new life into American manufacturing and, after years of challenges, we are excited about the bright future in store for communities all along the Shale Crescent.”

This post appeared first on Energy In Depth.