The people of Texas have once again been reminded of the crucial role oil and natural gas play in funding critical state programs in Texas thanks to record-breaking tax and royalty payments.

The Texas Oil & Gas Association’s 2022 Energy & Economic Impact Report found that in Fiscal Year 2022:

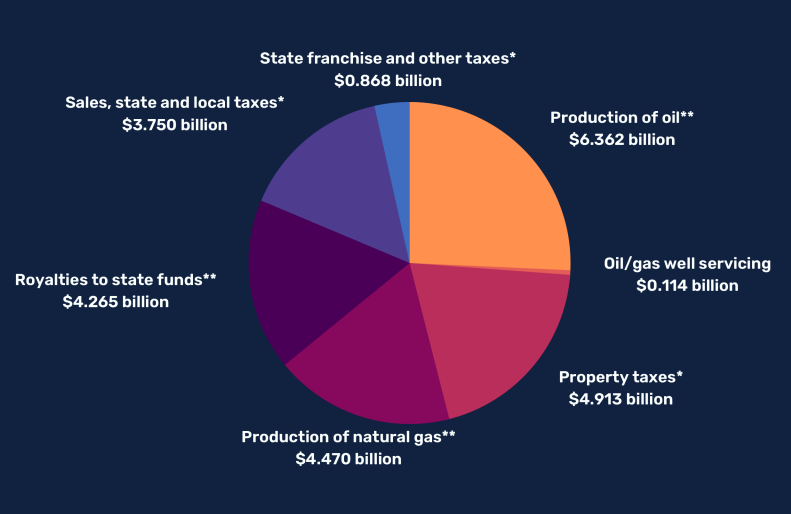

“The Texas oil and natural gas industry paid $24.7 billion in state and local taxes and state royalties—by far the highest total in Texas history—shattering the previous record of just over $16 billion set in 2019 by 54 percent.” (emphasis added)

The report further explained:

“$24.7 billion translates to roughly $67 million every day that pays for Texas’ public schools, universities, roads, first responders and other essential services. Production taxes and royalties to state funds more than doubled over fiscal year (FY) 2021. Production taxes grew by $5.8 billion, a 116 percent increase and royalties to state funds increased by $2.2 billion, a 102 percent increase. Oil and natural gas production taxes exceeded $10 billion for the first time in Texas history.”

Source: TXOGA 2022 Energy & Economic Impact Report

TXOGA’s report comes on the heels of the release of the 2024-2025 Biennial Revenue Estimate by Texas Comptroller Glenn Hegar. With a record-breaking projected revenue of $188.2 billion, oil and gas tax collections are projected to generate $13.3 billion and $8.6 billion, respectively.

Source: Texas Comptroller Biennale Revenue Estimate

Funding Critical Services

A large portion of oil and natural gas tax collections in Texas go to the Economic Stabilization Fund (ESF), and the State Highway fund (SHF), with another percentage going to the Texas Guaranteed Tuition Plan. ESF, commonly referred to as the ‘Rainy Day Fund,’ functions like a savings account for the state, to be used to prevent or reduce massive cuts to services such as schools, including higher education, and health care. As the primary funding source, the Texas oil and natural gas industry has contributed more than $28.1 billion to the Rainy Day Fund since its creation in 1987.

The SHF – which is partially funded by oil and gas revenues – is Texas’s primary funding source for the State’s department of transportation and the Texas Guaranteed Tuition Plan, which allows in-state students to prepay for future college tuitions and required fees at today’s price.

TXOGA President Todd Staples responded to the Comptroller’s report, saying:

“Today’s announcement by Comptroller Hegar is welcome news, and a continued testament to the enormous benefits of oil and natural gas activity for all Texans. By providing billions in funding for public schools, roads, universities, first responders and the Rainy-Day Fund, the taxes paid by this industry help make the Lone Star State the envy of the nation. We look forward to the work of the legislature this session to pass sound policies that allow this critical industry to continue to provide for Texans.” (emphasis added)

Conclusion

For Texans to continue to reap the epic benefits brought forth by the oil and natural gas industry, it is imperative that the policies in Texas continue to be smart, focused on addressing the needs of everyday Texans, and work with the oil and natural gas industry who time and time again have proven to be critical to the economic development of Texas. As Staples explained:

“The Texas oil and natural gas industry plays an extraordinary role in securing our state and national economy and advancing global stability. However, growth is not guaranteed, and policy can promote prosperity, or can hinder it. Policies and politics in Texas and across our nation will determine if we can continue to deliver for Texans while meeting our nation and the world’s energy needs.”

The post Big Gains from Oil and Natural Gas in Texas appeared first on .

This post appeared first on Energy In Depth.