DT Midstream completed its spinoff from DTE Energy on July 1, emerging as the “only independent, mid-cap, C-corp, gas-focused midstream company” with assets in the Marcellus/Utica and Haynesville shales.

“This is a historic day for DTM as we begin our journey as a premier, independent midstream company,” commented DT Midstream President and CEO David Slater in a release by the Detroit-based company on July 1.

DTE Energy, a diversified energy company, previously announced its intent to spin off its DTE Midstream business last October as part of a plan to transform itself into a predominantly pure-play regulated electric and natural gas utility. Under the separation plan, DTE Energy shareholders were expected to retain their current shares of DTE Energy stock and receive a pro-rata dividend of shares of the new Midstream company stock in the spinoff transaction.

Shares of DT Midstream are set to begin trading on the New York Stock Exchange under the symbol “DTM” following the successful completion of the separation from DTE Energy on July 1.

“I am incredibly excited about our opportunities going forward,” Slater continued in his statement. “DTM will be distinctive in the sector connecting world class natural gas basins to high quality markets.”

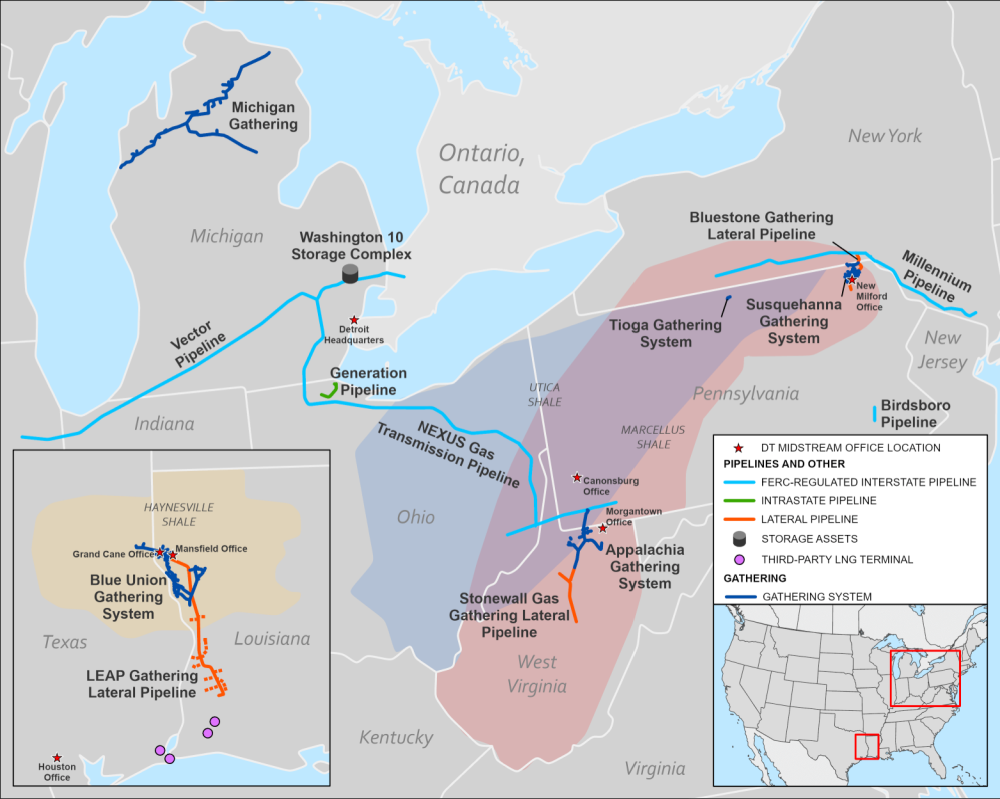

DT Midstream has a portfolio of integrated assets comprising natural gas interstate and intrastate pipelines, storage and gathering systems and compression, treatment and surface facilities strategically located in the premier Marcellus, Utica and Haynesville dry gas basins.

The integrated asset portfolio includes 900 miles of Federal Energy Regulatory Commission regulated interstate gas pipelines, 290 miles of intrastate lateral pipelines and over 1,000 miles of gathering lines. It also owns and operates 94 Bcf of regulated gas storage capacity in Michigan.

Through its asset portfolio, DT Midstream transports natural gas for electric and gas utilities, power plants, marketers, large industrial customers and energy producers across the Southern, Northeastern and Midwestern U.S. and Canada. The company offers a comprehensive, wellhead-to-market array of services, including natural gas transportation, storage and gathering, according to the release.

For 2021, DT Midstream expects operating earnings of $296 million to $312 million or $3.06 to $3.22 per share. The company also expects an adjusted EBITDA of $710 million to $750 million in 2021, delivering 7% growth compared to 2020.

Additionally, DT Midstream expects the area of ESG to be a “great business” opportunity for the company going forward, the release said.

“Because of our stable cash flows and financial strength, we are well positioned to capitalize on highly accretive growth projects within our platform as well as other economically attractive opportunities,” Slater added in the release. “We will remain disciplined with our capital allocation and focused on delivering exceptional service to our customers and superior value to our shareholders.”

As part of its ESG commitment, DT Midstream plans to achieve net-zero carbon and greenhouse-gas (GHG) emissions by 2050 using existing technology solutions plus new low carbon initiatives that are in development. The company has an interim reduction target of 30% by 2030.

According to its release, DT Midstream is one of the first midstream companies to begin implementing plans to achieve net-zero carbon and GHG emissions.

This post appeared first on Hart Energy.