Ultra Petroleum Corp. emerged from bankruptcy on Sept. 16 as a private operator with the new moniker UP Energy.

After struggling with nearly $2 billion of debt left on its balance sheets despite a previous restructuring, Ultra, one of the largest oil and gas drillers in Wyoming, voluntarily filed for Chapter 11 bankruptcy in May. The company had previously completed a restructuring in April 2017 after entering bankruptcy a year prior.

Through its latest financial restructuring, the company eliminated approximately $2 billion of indebtedness from its balance sheet. Additionally, the company entered into a syndicated reserve-based revolving credit facility with a $60 million commitment amount and an initial borrowing base of $100 million.

“We are excited about the future of Ultra,” President and CEO Brad Johnson said in a statement on Sept. 16. “With a pristine balance sheet and a large-scale, low-decline asset base that generates cash flow, the company is well positioned to effectively manage future commodity cycles and opportunistically pursue acquisitions that enhance our large proved developed producing reserve base.”

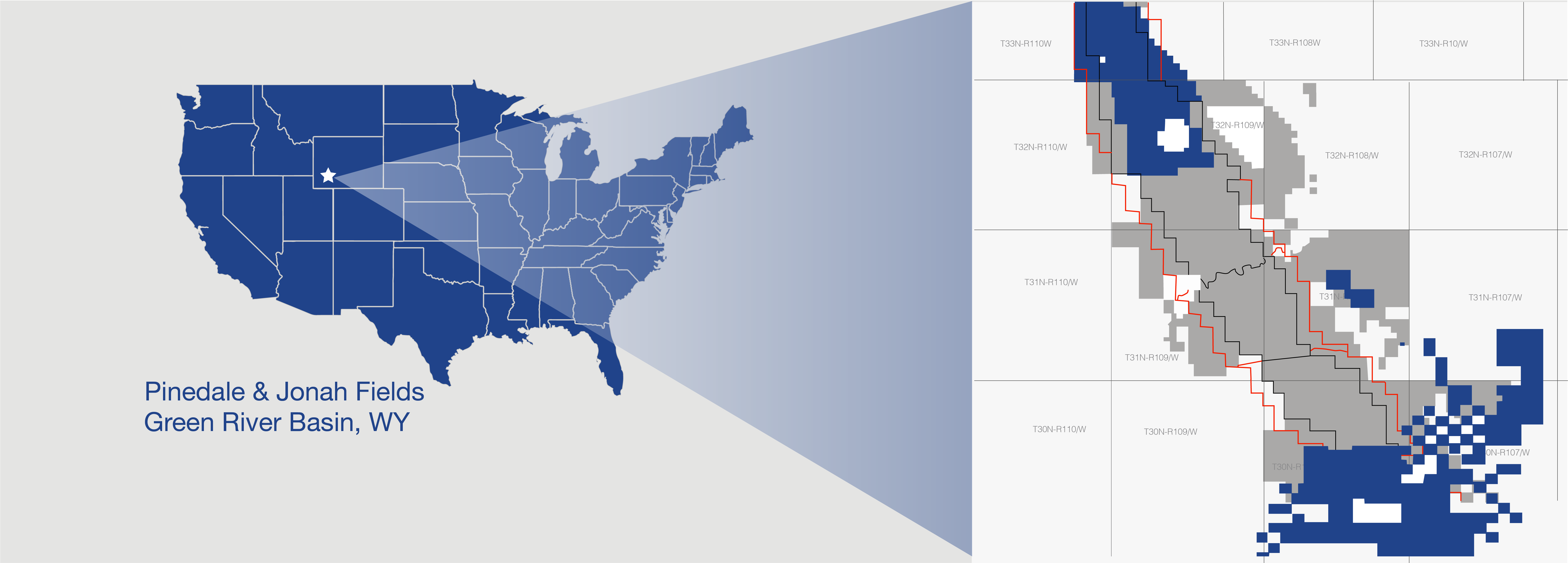

UP Energy controls more than 117,000 gross (83,000 net) acres in and around the prolific Pinedale and Jonah Fields of Wyoming’s Green River Basin. The company expects to generate “significant free cash flow from a large-scale, low-cost base of natural gas and condensate production,” according to its release.

The day after emerging from bankruptcy, UP Energy Corp. converted from a Delaware corporation to a Delaware limited liability company and changed its name to UP Energy LLC. Ultra Petroleum Corp., a Yukon corporation, will be dissolved in connection with the emergence process.

The company also appointed a new board of managers upon emergence from bankruptcy.

Centerview Partners was financial adviser to the company. Kirkland & Ellis LLP served as the its legal counsel and FTI Consulting was restructuring adviser.

Evercore Group LLC was financial adviser, and Stroock & Stroock & Lavan LLP served as legal counsel, to an ad hoc group of Ultra’s senior creditors in connection with the restructuring.

This post appeared first on Hart Energy.